As the world gears up to celebrate the 2024 International Women’s Day (IWD), organisations are presented with a unique opportunity to go beyond surface-level gestures and engage in impactful initiatives that genuinely contribute to the advancement of women and #InspireInclusion. Instead of resorting to impact-washing activities like brunches and webinars, organisations can champion initiatives that leave a lasting imprint on gender equality and empowerment.

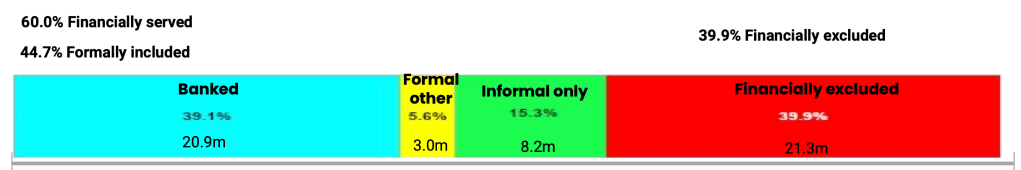

As outlined in the Framework for Advancing Women’s Financial Inclusion in Nigeria, the nation’s ambitious goal of eliminating the gender gap by the end of 2024 remains significantly out of reach. The EFInA Women’s Economic Empowerment in Nigeria report indicates that nearly 40% of women in Nigeria still face financial exclusion, with almost 50% of women entrepreneurs lacking access to essential financial services to enhance their businesses.

To address the persisting gender gap in financial inclusion in Nigeria, we call on organisations can champion tangible initiatives to empower women economically and enhance their access to financial services:

Financial Literacy Programs: Organisations can launch a series of comprehensive financial literacy programs tailored for women. These initiatives can include workshops, seminars, and online resources to educate women on financial management, budgeting, and investment.

Microfinance and Women’s Entrepreneurship Support: Organisations can establish or support microfinance institutions that specifically cater to women entrepreneurs. Provide access to small loans, mentorship programs, and business development resources to empower women in business.

Digital Financial Inclusion Initiatives: Organisations can promote and support digital financial inclusion initiatives that leverage technology to reach women in both urban and rural areas. This can involve partnerships with fintech companies to create user-friendly mobile banking solutions.

Women-Targeted Savings and Credit Programs: Financial institutions can design savings and credit programs specifically tailored to the needs of women. These programs can offer flexible terms, lower interest rates, and customised financial products to encourage women to participate.

Partnerships with Women-Owned Businesses: Organisations can foster collaborations with women-owned businesses to provide them with better access to financial resources. This can involve creating special funding schemes, offering low-interest loans, or establishing grant programs.

Entrepreneurship Training and Incubation Centers: Organisations can develop entrepreneurship training and incubation centers for women, providing them with the necessary skills, resources, and mentorship to start and sustain their businesses.

Community Outreach and Awareness Campaigns: Organisations can conduct community outreach and partner with women-focused NGOs to raise awareness campaigns and educate women on the importance of financial inclusion. This can include engaging local leaders, using media platforms, and organising community events.

Flexible Financial Products for Women: Financial institutions can design and implement flexible financial products that cater to the unique needs and preferences of women. Non-financial institutions can also partner with existing financial institutions. This can involve offering savings accounts with lower minimum balances or creating women-focused investment portfolios.

Inclusive Hiring and Leadership Practices: Organisations can make deliberate effort to adopt inclusive hiring and leadership practices that empower women within their workforce. This can contribute to closing the gender gap not only in financial inclusion but also in various professional sectors.

Government and Policy Advocacy: Organisations can advocate for policies that support women’s financial inclusion at the government level. Collaborate with policymakers to create an enabling environment that promotes equal access to financial services for women.

By championing these initiatives, organisations can play a pivotal role in narrowing the gender gap in financial inclusion, fostering economic empowerment and creating a more inclusive financial landscape for women in Nigeria.